|

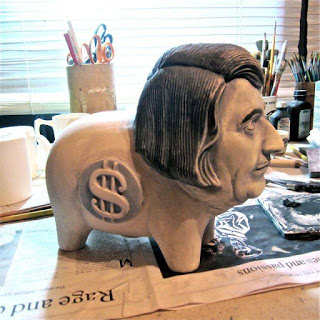

| Ayn Rand, by Charles Krafft |

In her next novel, Atlas Shrugged, Ayn Rand attacked altruism. The talented and creative people go on strike and the USA collapses. After the collapse the creative people return to build a society based on “the virtue of selfishness.”

The extreme individualist ideology that she espoused directly conflicted with mainstream social thinking since the Great Depression, which was based on the (true) understanding that uninhibited pursuit of self-interest had been an underlying cause of the Depression. Rand was propagandizing for that piece of acquired wisdom to be discarded.

Ayn Rand’s circle considered themselves to be promoting a revolution toward “a totally free society.”

Enter the idolators of technology. Silicon Valley entrepreneurs of the 1980s were heavily influenced by Ayn Rand. The Californian Ideology said that computers would enable everyone to become a Randian hero. Computers would allow the world to become more free, ordered through individual choices, with less need of government to maintain order, including less need of economic regulation. Extreme individualism and antipathy toward government translate into globalism and free trade.

Allan Greenspan was a member of Ayn Rand’s circle. An economic boom started during the Clinton administration, after Allan Greenspan persuaded Clinton to cut taxes. It was believed that the boom could go on forever because of the controlling factor of computers, keeping everybody well informed and preventing anything from going too far as had occurred prior to the Great Depression. This was called “the new economy.”

Greenspan worried, however, because he noticed that profits were increasing while there was no increase in productivity. He warned in 1996 that the market was overvalued, but then changed his mind under pressure, deciding that computers were somehow contributing to productivity in ways that he could not detect.

The documentary points out Ayn Rand’s inability to live in a purely rational manner, while convincing herself that everything that she did was rational. Similarly, despite the pervasive implementation of new technology, human nature remained the same.

By 1997 the U.S. Government was dominated by global free-trade thinkers. Southeast Asian nations were pressured to open their economies to foreign investment. Joseph Stiglitz of the Council of Economic Advisors was worried about this. He says that it was only in the interest of a very small group of people to do this. Secretary of the Treasury Robert Rubin blocked the CEA’s attempt to warn the president. Stiglitz believed that Rubin was working for the finance markets.

Overly optimistic investment in Thailand and South Korea led to economic crisis in those countries. The IMF offered loans to stabilize their economies, under the condition that the governments eliminate economic barriers in those countries. Indonesia also was pressured to make this agreement in 1998. What happened was that the IMF bailout money was used to allow Western investors to withdraw their investments: then the economies collapsed. Then U.S. taxpayers had to bail out the IMF.

Robert Rubin was making these decisions while Bill Clinton was tied up with the Monica Lewinsky scandal. Power over U.S. foreign policy had been transferred in effect from the elected President of the United States to financiers. (This could last so long as the president is merely an idiotic or corrupt frontman willing to acquiesce in plutocratic predations.)

The attack on the World Trade Center was an attack on a symbol of the Ayn Rand ideology. This economic shock exposed weaknesses in the economy: many companies like Enron had been falsifying profits and concealing debts. (Result of deregulation.)

Stability of the U.S. economy after the World Trade Center attacks was maintained by the Chinese Politburo. China sold cheap goods to the USA and used the profits to buy US Treasury Bonds, which in turn funded lending to bad credit risks. In 2008, when this orgy of bad lending came to a crashing end, the United States taxpayer was required to save the bankers from the consequences of their bad lending decisions just as had occurred in 1998.